By Rocio Ferro-Adams January 2025

The Current State of International Affairs

The Labour Government won the UK General Election on 4th July 2024. It has had some months to settle into government and it has made a number of policy decisions and made promises to the public in these months, which reflect Labour Policies from the Election Manifesto. But this is a new Government, and those promises, political decisions and actions are quite different from those of 1997. It is a Keir Starmer’s Government, with a mix of old and new Labour MPs, with varying experience and influence on UK Politics – a government with a wide range of views. Some hold clear labour socialist opinions (with a small s) and values, whilst others are centre-left and are declared liberal internationalists in their approach, which differs markedly from traditional Conservative values and opinions. Blue Labour has also filled a void of conservatism with a small ‘c’ from within Labour which align with Kier Starmer’s personal values. The Prime Minister’s personality is also shaping policies and government, in his response to world events, which are very different from those facing Labour more than 20 years ago.

The Labour Government has committed to spend and invest in public infrastructure and wages, but the Chancellor has chosen to raise taxes on incomes, which has begun to impact private businesses and employment – how much negative impact was foreseen in October 2024 when the Budget was received is unclear and whether there had been other options not to raises taxes as inflation was already down to a manageable level. Would a more conservative approach have been preferred, by reducing government and public debt – or in this case, where institutions had been seen to be failing, would this have felt like too much austerity to the public? As Lord Hammond outlined on Radio 4 BBC World at One on 9 January 2025, that the Labour Government is now limited with inflation at 2.6% (CPI) in November to 2.5% (CPI) in December 2024, and with expected rising unemployment, increasing public sector pay and spending, this may mean a slowdown in delivering areas of their manifesto policy commitments to the public sector – promises already made.[1] Core inflation is around 3.2 % if you take essentials and basics like food and fuel, and alcohol out of the equation, hotels and restaurant sectors face higher inflations costs at 3.4% in December 2024. The main concerns are about any additional shocks to confidence in the markets, more recently expressed, where the pound sterling fell to $1.21 dollars for the first time. Markets are about confidence and real returns, so interest rates matter.

The UK’s Position in the Global Economy

Britain is not the largest power in international relations or the global economy, but it does hold important seats in the G7, World Trade Organisation (WTO) and G20 and diplomatically it has influence at the UN. It’s international trade and trade with partners means that it continues to have a seat at all of these tables, and it is perceived as punching often above its weight. The reality outlined by Lord Hammond, is not unsupported. The British Chancellor visited China in January to discuss trade and diplomacy. Britain, he argues will want to work with China, keeping open transactional trade, but protecting the security of sensitive industries and vice-versa. The UK does not have the industrial capacity or access to the raw materials necessary for instance, to build its own car batteries for a global supply-chain dependent British car industry. Until now. It has a very much interdependent relationship in global trade which differs in degrees of trade interdependence to that of the USA. China, the EU, and the USA and Canada are all important trade partners to the UK. Including India and countries in Latin American and Africa. Growth has also been slow for several years and today the UK is avoiding recession, where growth in December 2024 was below 1% of GDP. Growth is an indicator of prosperity, and a balance is necessary to ensure sustainable and environmentally stable growth, therefore many EU counties have growth levels below 7%.

A Change in President at the Whitehouse and shifts in policies and geopolitics

The transition between a Biden President government to one led by President Trump will be different in two areas, where President Biden engaged with global power politics, and international relations, in the wars in the Middle East and Europe, accommodating power challenges from Iran, and elsewhere. President Trump may be advised to develop a more protectionist conservative stance, which is isolationist. He has now taken office on 20 January 2025. All transitions of power have the capacity to impact the global economy. Politics impacts trade relations. The UK BBC media have carried some important stories on 15 January 2025, in response to his Inauguration as President and his Second Term. International Press Coverage by Reuters reports that Chinese President Xi Jinping called European Council President Antonio Costa to say, “that China and the EU have a robust symbiotic economic relationship and Beijing hopes the bloc can become a trustworthy partner for cooperation”. “As long as China and Europe respect each other as equals and engage in sincere dialogue, they can advance cooperation and achieve great things”. The reality is that the greatest threat to the global economy is the potential for armed conflict. Which destabilises regions, borders and states.

The world in which President Trump left office is different to the one in which he was President five years ago. The Biden Administration gave a commitment to support the war in Ukraine, a significant financial package and a political commitment to NATO, which he now has the option to continue to support. Articles in Foreign Affairs question how he will manage three adversaries China, North Korea and Iran. They warn that if the USA should decide to retreat into ‘Fortress America’, it will weaken the international position and world security around trade through new attitudes and policies in the Middle East (Israel is a partner of many Western countries), but acceptance of an easy solution to Gaza’s territorial integrity may destabilise the region as tensions grow around the accepted international regimes of state affairs and norms at the UN on issues such as two state solution for Israel and Palestine. Old and new state adversaries may seek hegemony, contemporary international relations theories suggest that ‘middle powers’ in BRICS may seek to fill gaps left behind, including those adversaries who may become uncontained and prone to threats of violence and war in the region from within Yemen, Iran and now even Syria which create some risks after the fall of Bashir – the replacement government is new and the path is still not clear as to the kind of relationship that it will have with the USA.[2] Therefore economic shocks in the global economy due to increasing global insecurities wars and environmental changes, may be unavoidable, and as a consequence trade must be made secure, avoiding stockpiling, managing tensions and changes in migration, and labour patterns.

Writing in The Times on 15 January, Jack Bennett (Economics Correspondent) examines the broader spectrum of scenarios through the spectrum of Economists who warn of “Cold War-style deterioration in relations between the United States and China partly prompted by Donald Trump’s threats to implement steep tariffs on Chinese imports”. Such a scenario could ignite a global trade war leading to contradictions in global trade, impacting Central Banks who may halt or even reverse the course of intention to cut interest rates”. [3]

President Trump announced policy intentions which impact great power politics and international security. Shifts in geopolitics are expected. The media suggests a change within Ukraine, with concessions to Russia, and with a ceasefire announced in Gaza the weekend before the inauguration of the new President on 20 January, this all suggests that the Trump Presidency has precipitated strategic decisions, which impact international security in the Middle East, but not yet in Ukraine. He has announced tariffs on countries running trade deficits, those who ‘export more than import’, which may include China and the UK and a number of Latin American countries as well as Canada. These moments are politically complicated, and unclear, but some analysts suggest that this is always a way of enabling some opportunities for business, if these can be grasped then some economies will grow, challenging market uncertainty. Alternatively, policies such as proposed tariff increases of 10-25% could cripple some industries in a number of countries, if future negotiations are mishandled. Presidential statements about taking Greenland, the Mexican Border, the Panama Canal, and withdrawing support from Ukraine, may be rhetoric by the returning President and his Team, but it should be taken seriously as strategic intent, seeking leverage for negotiations in the form of new power diplomacy.[4]

China and the UK trade dialogue in January 2025

The Chancellor Rachel Reeves has visited the UK’s fourth leading trading partner China, to secure Chinese commitments to discuss sensitive issues, whilst safeguarding national security. The Government is committed to trade and secured a £600m deal for Britain over 5 years, for the UK economy.[5] Although she was criticised in Parliament for leaving the UK whilst the markets raised concern about the lower value of the pound, and high borrowing costs, she defended the recent diplomatic meeting on 14 January 2025, as necessary to assure continued expansion in foreign markets for the purpose of economic growth.

The meeting assured the continuity of the UK-China Wealth Connect Scheme and the launch of a new China Green Bond in London markets, for the first time (an overseas sovereign Bond). A number of Financial Services Firms had advised the Chancellor to attend meetings in China, resulting in continuity of secure pensions, a sustainable finance launch, vaccine approvals, automotive trade, whisky labelling, legal services which she described in Parliament on Tuesday14 January 2025 as pragmatic co-operation, seeking a secure and balanced relationship with China, and presumably fairer competition into Chinese markets.[6] This included discussions on unfair sanctions against UK Parliamentarians and individual Human Rights cases. The Chancellor has been accused of socialism, increasingly unable to reduce high government debt. She is left with three options, as Lord Soames suggests, to borrow more, cut spending or to raise taxation to meet public spending commitments, and to fill the £22bn hole which the government has inherited. All of which would breach her Fiscal Rules set out in the October 2024 budget. It is early days, and the Government seems to be seeking opportunities in the Global Economy, to rebalance trade and to foresee problems. It may continue to seek those in Europe, and elsewhere. The danger, of an exposed approach, is that as relationships are recalibrated, perceptions of contradictions by the market forces, may create uncertainty.

Shifts in the global economy – anti-slavery legislation China a Case Study.

All Western nations are affected by shifts or weaknesses in the liberal rules-based order, and therefore great powers are expected to respond, by diplomacy or co-operation, agreements and action, which lead to resolutions, the characters of statesmen and women determine the course of those decisions, actions which prompt them to respond to moments in geopolitics. These are prompted by and large by wars, disasters, threats, conflict and economic shocks. But power must be used carefully and not in a disproportionate way, which is unbalanced or too destabilising least they lead the world into a situation which cannot be corrected, or undone. BRICS provides an alternative trading and political area where the South see a rebalancing of relations with the West, which is fairer to them, this includes India, China and Russia, large power brokers in the global economy and in international relations. This organisation is growing, and as more members perceive it as a useful forum than not. weaknesses in the UN system, therefore become apparent as BRICS becomes more successful, but flexible ‘Western style democracy’ is something which all states seem to want to embrace in theory and in many cases reality.

Both the EU and Britain have introduced and updated Anti-Slavery Legislation and implantation possibly in response or on reflection of the USA’s stance on goods produced in the Xinjiang region, which produces over 80% of the world’s cotton and 23 % of solar energy products. A region associated with poor Human Rights records of the treatment of Uyghur and Turkic Muslims and the use of minority groups in forced labour camps. Accusations being that this labour is feeding the economy in Xinjiang China, a country where the government invests public finance into corporate businesses. The Chinese Government can provide public incentives for businesses directly, which has limited the openness of Chinese markets, but ensures their competitive strength in a global economy – where smaller nations and middle economies remain unable to compete with this level of investment. Change in USA law and anti-slavery legislation in western nations since around 2015 mean, that there is a legal acknowledgment that forced labour described as slavery, say under the Modern Slavery Act 2015, is unacceptable. This creates a pressure and tensions to, as these behaviours are challenged in the global order, to precipitate change.

Cases raised in the UK since 2015, calling for protection of these minority groups and a ban on trade, suggests, that although the legal framework is there, it is largely difficult in the UK Courts to find wrong doing and to proceed with prosecutions of companies, due to the legal difficulties in linking the region, slavery camps, and UK trade – despite video evidence of the camps, it cannot be connected to the products sold in the UK in 2024.[7] The United States has taken the blanket approach that anything produced in Xinjiang is possibly a product of forced labour. Laws coming into effect in 2025, are likely to outlaw these products completely in the USA, soo the risk is that stockpiling has already taken place by businesses as the ban is implemented. The UK has brought companies at risk to explain their position in Parliament. The EU also tightened its legal framework in 2023. Although there are some calls in the UK and discussion from within Parliament to ban goods from Xinjiang, that is not currently the position.

Trade is impacted at a global economic level when supply chains become dependent on specific labour. Forced labour risks the values underpinning the global economic world order, and human equality and rights, which should not reduce the levels of moral values and actual regulations of institutions. The Western liberal conception of global economy calls for a balance and integration of human rights across all levels of production worldwide. Monitoring how that happens, and what sanctions will be put in place in response to horrific situations in disclosed or uncovered locations, would be a significant milestone for global human rights, if it can be proven and sanctions implemented; supply chains for products could then be affected, adapted and amended permanently for fairer trade with other nations. The relationship with China will need to be managed carefully and diplomatically over the next 5 years. And this meeting may be a good start. Its outcomes are listed in notes via a link to HMT.

Challenges of the UK Economic Model and Structure

The UK economy is not growing more than 0.7% in January 2025 and this along with rises in taxation have caused problems for business confidence and confidence in the markets. It has impacted the value of the pound, and jobs, as the changes on tax on income and private education, will impact how much employers have to spend on wages, which in turn impact retail prices as there are fewer shoppers with extra money to spare. Higher prices in fuel at the point of origin, have over the years increased the cost of transporting costs, economic shocks caused by wars and sanctions and increasing border tensions, means that security around transportation is also a problem in Eastern Europe and around the Middle East.[8] The UK Economic Model is described as being driven by competition, open to Foreign Direct Investment (FDI) and largely dependent on protecting property rights (which also represent inherited wealth). It is a model based on and driven by open competition and investment.

New areas of growth in manufacturing would mean reconsidering in some instances, whether a few areas of the global supply chain for goods and products to the UK could be produced in the UK, with a greater emphasis on British Technology production. Access to raw materials may be an issue; that requires negotiation and new trade agreements, but whether some indigenous raw materials could be used as alternatives would need to be explored. Also, the development and patenting of British ideas, research and development, within the UK industrial strategy to develop manufacturing to boost the economy – should be followed through and developed further where it can. Green Energy sectors provide capacity and opportunity for research and development and science innovation.

So what is the problem?

The problem today is that the existing higher rates of borrowing for the government, increased core inflation to 3.5 % in November 2024 and low economic growth estimated by the OECD to be about 1.7% in 2024, means any headroom for public spending is now diminishing.[9] The Chancellor has the option to borrow more, this may have little effect on confidence in the markets, as British Government debt continues to rise. Public Sector commitments to spend on prisons, universities and the police may all be impacted – with serious social consequences. Banking regulation must be up to speed to prevent weaking the Banking regimes, so delay in implementation of Basel Rules by both the EU and UK until 2027, could have some implications, creating unnecessary slack for risky opportunities.

Tech Company development in the UK are seen as a rare, but there are opportunities to grow companies of high value. Competition is a problem for the UK and it must learn to shield fledgling start-ups which can develop into larger successful companies over time. Baroness Gustafsson of Chesterton, Minister for Investment was interviewed several times in The Times this month, states that “Darktrace a successful company in which she helped to develop and was the CEO, sold for $5.3bn (£4.3bn) to Thoma Bravo a private US company after floating on the London Stock Exchange. The company sold on completion within 7 months of a bid being made”. Other examples include SAGE, an FTSE 100 accounting software company, publicly listed that has a value of £10bn and ARM, a chip company sold in 2016 to a Japanese software company, for £24.3bn. Revolute digital bank may fetch $45bn (£37bn) if it also opts to list on market.[10] These are examples of home grown companies that sell well and have development potential.

UK Balance of trade, goods and services

The UK exports of goods and services totalled £844bn and imports £866bn in 2023, where the EU remained a main trading partner accounting for 41% of trade in both sectors and 52% of imports into the UK in 2023.[11] The UK had a trade deficit of £164bn in services and £186bn in goods, therefore the UK was importing more from abroad. It was running an overall trade deficit with the EU of £99bn and a trade surplus with none-EU countries – this trade deficit with all countries grew by £11bn, in 3 months to November 2024.[12] The argument is that Britain needs to grow its economy, but it is not doing badly, as it has good trade relationships and balance sheets. It would therefore be ideal to try and close the deficit gap.

The ONS published data state that the “underlying UK current account deficit excluding precious metals widened to £20bn or 2.8% of GDP (July-Sep 2024 Q3. This is a change of £2.1bn from the previous quarter”. “The total trade deficit, excluding precious metals, expanded slightly to £6.8bn as the goods deficit narrowed to £51.2bn and the serious surplus decreased to £44.4bn”. “ The preliminary estimate of the UK’s net internal investment liability position on 30 September 2024 widened to £836.7bn from £732.7bn on 30 June 2024”.[13] Account deficits are taken into account when balancing the books at HM Treasury.

The health of an economy is a about the exercise of balancing the books, and pragmaticism with borrowing, coupled with recognising reaction of the markets to decision about policy on companies growing or floating on the UK Exchange. Currency markets also react to economic performance and are symptomatic of health problems – in the state economy and public spending. Inflation, interest rates, recessions, and the wider global economy and geopolitics, impact markets and currencies and Bond Yields.

At a glance : The UK Economy data reveals

The ONS annual rate of inflation CPI for the UK in 2024 was 2.5% in December 2024, a rise from the Bank of England’s desired rate of 2% in May 2024. [14] ONS data states GDP chained product volume was found to be £639,452M in Q3, a slight rise from £637,023M in Q2 in 2024. There has been a steady rise since 1995 in chained GDP volume measures until 2020, when the UK economy was impacted significantly by the Covid pandemic, dropping from £604,719M in 2020 Q1 to £481,768M in 2020 in Q2 rising slowly to £562,648M in Q3.[15]

The UK Economy growth to GDP figures show 0.0% change over months September-November 2024, declared to Parliament and presented by the UK Parliament dashboard as falling in April, July, October and rising by 0.1% in November 2024 after the October budget statement.[16] There has been little change in GDP since 2010, with all yearly growth being under 1%, (0.9%) in 2024 and 0.4% in 2023. Growth has not been static, but slow and low to previous years. Given volume of production relative to its own growth, the UK GDP figures are stable.

The Consumer Price Index (CPI), inflation change was high in 2022 at 11.02 %, in October 2022, the Consumer Price Index Housing (CPIH) costs were 9.6% in October that year.[17] With careful management of the economy this fell to 2% (CPI) in May 2024 and 2.8% (CIPH).[18] Data published in December 2024 shows the UK to have a CPI of 2.5%, CPH 3.5% and a retail cost price of 3.5% RPI (since August 2024).

About 80% of the UK Economy output is derived from the Service Sector which includes professional services, law, engineering, accounting, architecture and financial services, business, IT and communications and administrative support.[19] In London that figure is as high as 93%. Across the UK Manufacturing accounts for about 9.1%, retail and wholesale 9.1%, property sales 13.1%, Construction 6.3% and Education 6.2%, Agriculture, forestry and fishing 0.6% and Mining and extraction 1.3%.[20] Aside from the service sector which has risen steadily since the 1990s, all other sectors have been in steady decline, with the exception of construction which although less significant in output has remained relatively steady.

Comparison: GDP% change growth across G7 countries has been under 1%, the USA since the last Q3 in 2024 saw a 0.8% change, France and the Eurozone 0.4% change and across the OECD and G7 average a 0.5% change in GDP from Q3. The UK was static at 0.0%. Post-pandemic some G7 countries bounced back, experiencing an 11% change in GDP from pre-pandemic levels, Canada 7.3%, Italy 5.6% and the Eurozone and France 4%. The UK rose by 2.9% and Germany 0.1%. OECD and IMF data project more growth for Canda of 2.5%, 2.2% for the USA and the UK 1.5-1.6% growth in 2025 (data published in October 2024). Expectations are lower for the Eurozone, France, Japan, Germany, and Italy (between 1.1%-0.8%).[21]

The employment rate of those of working age 16-64 is about 74.9% (2024) – those who are economically active, but this figure has dropped since 2020. Although 409,000 more people were in employment in October 2024 from the year before.[22] Unemployment rose from 3.8% in 2019 to 5.3% in 2020, then it steadily fell to 3.8% as new economic measures were put in place, businesses were interested in employing more staff, this has risen again to 4.3% in August-October 2024. Compared to other difficult economic times, in the1980s, when unemployment figures were around 12%, this did not capture those who were economically inactive and employment may have been as low as 65-70.9% (in groups aged 16-64). Unemployment Data sets from the ONS are updated on 21 January 2025.[23]

Trade (export to import) balance also maters, it tells us if the economy is healthy. The ONS data describes that EU value of goods imports dropped in November 2024 by 0.6% (£0.3bn), as there was less trade in goods between the EU-UK than the UK and none-EU countries. Whilst the value of goods export rose by 0.2% (0.85 in November 2024). In terms of the global economy, these are not vast numbers, for the UK they are significant. Most importantly the total trade in good deficit has widened from £3.8bn to £10.8 bn, in three months due to a fall in exports and not imports. The ONS state “The trade in goods deficit widened… in the three months to November 2024, while the trade in services surplus is estimated to have narrowed by around £1.9 billion to £43.3 billion”.[24] Focus on other areas of the economy such as manufacturing may help to rebalance some of the issues encountered, especially around green energy production.

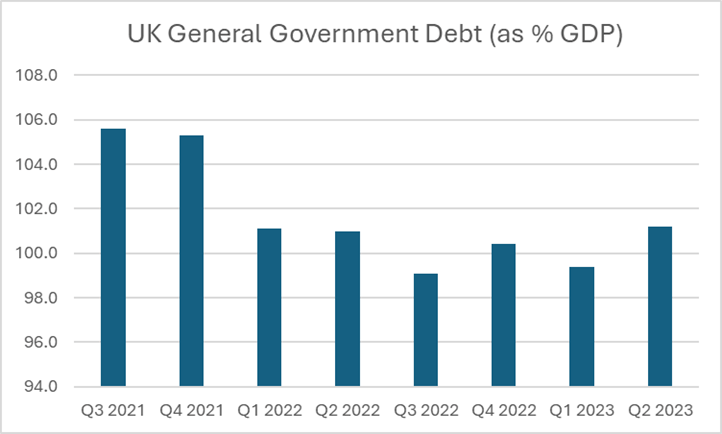

General government debt to GDP has increased substantially since 2016. £1,651bn in debt, equated to 84.5% of GDP, this remained stable until 2020, despite increasing borrowing, debt to GDP remained between 84.0%-83.0%, by 2021 this had risen to 103% of GDP with a debt of £2,233bn. Net borrowing was around £327.6 bn, 15.3% of GDP.[25] In Q4 2022 this figure had dropped slightly 101% debt to GDP, and in 2023 Q3 this figure dropped again by a small percentage to 100% debt to GDP. Although the UK had the third lowest % debt to GPD of all G7 countries, repayments are significant to the economy, it was 16.8% or so above the EU average in 2021. In September 2024 the UK Government spent more than it receives in taxes, borrowing £16.6bn. the highest amount of government borrowing since 2021.[26] The Chancellor has certain options in the future, but the current Budget decisions and fiscal rule need to bed-in. These options include further borrowing, at a higher rate, to pay for some public spending, as austerity or cuts at the next HMT Spending Review risk exasperating problem and inequalities in social care, prisons and policing, health, SEN special needs education, local government skills and education and re-employment programmes.

ONS Data UK General Government Debt 2024

The Challenge for the Government is to meet public spending budgets. Calls for further reform of Local Government existing structures, to deal with institutional problems. Reform and accountability around Audit of Local Government budgets is important as many Councils are in deficit some are soo badly affected that there should be a review of rules around audit and accountability to strengthen responsibility for decisions by Councillors made under austerity policies. Unitary Authorities do not have the capacity to raise taxes, but the Model if rolled out, does have the capacity to obtain further powers through devolution. A new Audit regime is being discussed.

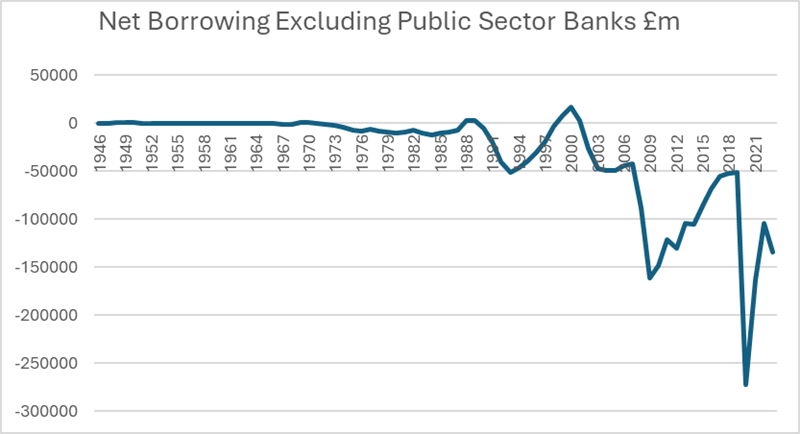

The past Audit regime has been abolished, but something constructive must take its place, with a progressive goal of local government earned autonomy, but avoiding becoming a model of superstructure overburdened, too large to deliver better services.[27] The OBR state that borrowing at around £4bn a year remains higher than the OBR forecast due to local government borrowing, which is much higher than expected.[28] This is significantly important and accountable and responsible auditing and monitoring remains an incentive to bring Local authorities back into the black. Net Public Sector UK debt stood at 93.% of GDP, estimated borrowing at £129.9bn 2024/25, “Local Government and public corporation borrowing being £4.1bn and £2,4bn respectively above the OBR October forecast and net Central Government borrowing stood slightly below profile by £2.4bn”.[29]

ONS Data on Net Borrowing Excluding Public Sector Banks £m

The UK Economy Sectors and trade with the EU

Agriculture

Agriculture is one the most stable and most essential parts of a state economy, largely the food production volume can be predicted by land volume, but it is at risk of environmental damage caused by climate change, overuse of land, poor crop rotation, and pollution. Draught across Europe over the last decade has caused problems to some salad crops in the UK and Spain, impacting local food markets.

In 2023 the total croppable land area was worth £6.1M, one third of the total utilized agricultural area (UAA), which also includes grassland, permanent grassland and common rough grazing. A total of which is 17-18M hectares since 2000. This land is used for a wide range of arable crops, cereals, wheat, barley, oats and oilseed. And horticultures, to grow crops like apples, pears, plums, vegetables and bulbs, which are worth about £43 bn a year (in 2022).[30] In 2023 1333,000 hectares of UK agriculture land was used to produce bio-energy crops, an increase of around 43% since 2015 (This accounted for use of 2.2% of arable area). Although this sector amounts to a much smaller piece of the whole economic pie, it is vital and no state would be able to sustain itself on imports alone, therefore it is essential to be able to produce food for public consumption, with some export for trade.

DEFRA reported in 2024 that in England in 2023, the majority of farms 54% were owner occupiers, followed by a mixed 31% tenancy, and 14% wholly tenanted. The North-East of England contains the greatest proportion of farms in the country at 21%, followed by Yorkshire and Humber at 15%, the rest are more evenly spread out across the Northwest, East Midlands, the East of England and the Southeast. Younger farmers are on the whole wholly tenanted farmers, 18% of which are under the age of 45 (2016).[31] It is important to get to know how farming is structured in Britain to understand change. Detailed reports by Defra are available on farming, and food security in Britain for September 2024.[32]

Post-pandemic, “the value of food and drinks exports fell in 2023 from 2022 figures, by £3.1bn (11%) to £24.4bn, the rate of food, feed and drinks imports decreased by £5.9bn (8.8%) to £61.1bn. The trade gap in food and drinks decreased by £2.8bn (7.1%) to £26.7bn. Principal destinations for exports were Ireland, (£4.1bn), France (£2.7bn), the USA (£2.4bn) and the Netherlands (£2bn). The main countries for dispatch for imports into the UK were the Netherlands (£7l.6bn), France (£6.3bn) and Belgium (£4.9bn) and Ireland (£4.8bn). Fresh fruit and vegetables together remain the highest value imports at £71bn and exports of fresh vegetables fell by 8.8% from the previous year, but exports of fresh fruit rose by 4% to £70M”.[33]

On beverages, Defra acknowledges that Whisky continues to have the highest export value, totalling £5,8bn, this was a decrease of 18% compared to the previous year. The Times reported in the Autumn of 2024 that the UK was seeking to open new markets in India and was exploring a better trade deal. The Wine and Spirits Trade Association (WSTA) reported that the October 2024 budget had an impact on goods produced, as headline alcohol duty rates will increase by 3.65%. Duty relief on draught products will be further cut by 1.7% with smaller Producer Relief also to be increased. A new duty rates regime was published and are to be available from 1 February 2025. [34]

The Food and Drinks Federation (FDF) report that there has been a decline in export in the second half of 2024, and that imports from EU and none-EU countries continue to increase, post Brexit checks on goods remains a fragile regime, as cost for processing are likely to increase. The EU is the UK’s largest trading partner in this sector, but it has fallen by almost 25%, certification requirements it argues is the reason for poor growth. It has also affected beef and poultry imports from the EU since the Export Health Certification Scheme on EU goods was introduced in the UK in February 2024. The UK will soon join the CPTPP, providing access to trade with 11 countries and opening opportunities for Malaysia.[35] Exports to India rose by 11.9% (with hope of future growth) via FTA Agreement and to Australia there was a 7.9% growth in trade export in 2024.[36] It also reports that many markets are down, and this is also reflected in the UK. Imports have increased by 3.2% in 2023-24. It identifies a 29.4% increase with Morocco and a similar increase of 24% in South Africa, Turkey 9% and 22.8% with New Zealand.[37] New administrative costs are considered by members of FDF to be an import barrier and recommend a reduction in tariffs on none-sensitive goods such as hazelnuts, to help UK businesses. FDF state that Duty suspensions earlier in April improved growth.

Impact of Policy Changes on agriculture in the UK

More uptodate data would be welcome to gain a better view on how farming will be impacted by changes to inheritance tax. As these are often family run businesses, this has not been a popular decision, as some farms will be forced to be broken up, or become incorporated companies, changing farming and potentially impacting predictable crop volumes and large-scale agricultural planning of foods which larger farms are able to do. The argument is that only a few farmers are to be affected on estates worth over £1M on agricultural land and business assets, but publication of data and impact assessments on farming over time would be constructive. Changes in farming even small ones can have environmental impact on surrounding farms and local countryside, soo who is farming and how it is done benefits from a stable approach for administrative and environmental and food processing purpose. The decision has naturally worried local farmers, who’s earnings although raised over 30 years, remains much lower than some middle salaries paid to corporate company staff in large cities. [38] OBR impact assessments are uncertain to some farmer organisations, and the OBR state future change in the sector may have to be gradually monitored over 20 years, rather than predicted.

Manufacturing

Manufacturing industries is one production sectors in the economy. It includes mining, electricity, water and waste management, and oil and gas extraction.[39]

ONS figures on manufacturing and production, industries note a -0.4% decline in this sector. UK manufacturing product sales were £456.1bn in 2023 an increase of 3.9% in 2022. Food Manufacturing remains the largest areas of the sector and accounts for 20.8% of total manufacturing sales in 2024.[40] The House of Commons Library published a note on 16 January 2025, which states that the sector includes electricity, water, mining, oil and gas extraction, in July-September 2024, the manufacturing sector accounted for 8.1% of UK employment and 8.8% of the UK economic output.[41] The sector in manufacturing output decreased by 0.3%.

The total value of UK Manufactured products sales were £456.1 in 2023 an increase of £17.2bn (3.9%) from £438,9bn in 2022. Food is the largest sector of manufacturing accounting for 20.8% of total manufactured products. The manufacturing of the motor cars and vehicles has the largest value increase by 22.0% £9.6bn in 2023 to £53.3bn, increases in combustion engines saw the largest value increase for any single product in 2023.[42]

The Government Policy Launched in November 2024 published in a Green Paper consulted over 3000 organisations/individuals and it launched its National strategy in December focusing on growth and breaking down barriers to trade.[43] It pointed to areas identified which have resulted in poor growth. On 17 December 2024, the Industrial Strategy Council committed to boost growth in living standards.

The Government identifies areas of persistent problems, it is ranked the bottom 10% of OECD Centres for the overall investment intensity since 1990 and the lowest investment in GDP in the G7. This is due to low levels of private sector investment and soo too public sector investment, which has tended to be low amongst the G7 nations. Despite attracting FDI as an economic strength, UK business investment is weak with 40% making investments in any given year, producing little jobs growth in the economy.

The economy is skewed towards London and the South-East, while city regions provide huge potential for development, identified as underperforming, but 69% of the population live in these cities and the surrounding areas. There has been weak diffusion of technologies and knowledge absorption, this is despite being the 5th out of 133 countries in the World Intellectual Property Organisation. The reports by the Business and Trade Department also found slowing market dynamics, which create overall productivity in the economy, which reduces productivity. The UK is hard working – yrt productivity is found to be lower than other countries in Europe.

Looking to the future, growth industries include:

- Advanced manufacturing,

- Clean Energy Industries

- Creative Industries

- Defence

- Digital Technologies

- Financial Service

- Professional and Business Services[44]

The UK has strengths in academic publication and is a benchmark for research quality. It is one of the world’s largest trading countries and has the second biggest service exportation in the world. It is one of the most globally connected in the world. Geographically it has excellent external transport links, and it is now producing 1 in 3 technologies products vital for net zero. Green energy technology is a growing sector. Its work force is strong, diverse and highly skilled, it is 4th in the EU, 7th in the OECD, for tertiary education, and is the most attractive nation to young people of the G20 nations to come to. UK market remain relatively competitive.[45] On 16 January 2025 the UK Government announced new investment deals which have come from FDI through car and engine manufacturing for electric vehicles. From both the UK Government and Nissan, and Japan’s Automotive transmission company, (JATCO), securing £50m in a partnership deal, creating jobs and a new plant in Sunderland, as well as jobs in AI and hundreds amongst supply chains. These are examples of more recent success and evidence of commitment to growth, especially in areas of the country which can be underperforming due to lack of investment. [46]

Mining

The UK Parliament note that the mining and processing of minerals underpins the production of modern technology, as well as infrastructure. Each year 3.3bn tonnes of mentals are produced each year. It states that prediction of demands for industry is likely to increase for renewable energy technologies, batteries, and electric vehicles. These technologies demand more mining of none-renewable minerals for renewable energy technology, which will have negative and positive impact on societies and the global environment.[47] It also imports mentals from China (12%), South Africa (6%) and the EU (10%).[48]

UK mineral production is relatively lower than other nations, but the largest mining companies are in the UK, with large investors and the London Metal Exchange being one of the largest in the world. It has a complex impact on society, bringing jobs and training to communities, but can damage the local environment through water contamination used in the industry. It impacts negatively and the industry disproportionately impacts women, indigenous communities and children worldwide. The Global mining industry is vast, and had revenue worth $848bn in 2022, although there was a marked decline in 2023 of $792bn. In 2024, Glencore was the world’s largest mining company in revenue (ONS).

The mining industry in Britain produces a mix of fossil fuels, such as gas, coal and oil, as well as mentals, such as tin, copper, gold and minerals for industry, such as China clay and limestone. Mineral production is worth £45.6bn each year, and the UK exports, £105.2m each year.[49] Mineral mining had been in decline in the UK and there is a trade deficit in minerals, especially in decline the industry has not recovered post pandemic, a decline of -£34.17m in 2021 and in 2022 a decline of £-63.3m.[50] However, since Q1 2021 mineral exploration has increased again in the UK and has risen over this period until December 2024. Monitoring of the industry is conducted by the ONS, and the industry is managed across a number of UK Government Departments such the Departments for Foreign Commonwealth and Development Office (FCDO), Business and Trade, and Trade and Industry .[51] The general views is that demand for mining is likely to increase outstripping recycling inputs to industry of some mentals such as copper, used in wires and cables. The largest Company by far amongst all the companies acting and investing in the UK is Rio Tinto, lithium production is also to go-ahead with a new deal between the Rio Tinto and Green Lithium – securing critical battery material supply chains for the UK.[52] The UK does less mining relative to the world industry, but it is the HQ of many world mining companies. Tin is also likely to be increasingly re-explored and mined in the UK as a vital component in Green Technologies, so there may be some changes to come to the UK mining industry and local communities. [53]

Oil and fuel

The oil industry is vital to the global economy as it provides fuel for transportation and mechanised industries. It is divided into three sections upstream (exploration and production), midstream (transportation and refineries) and low stream exploration (refining and selling products). World Crude oil reserves are fossil fuels and reserves are managed, these are used in manufacturing chemicals and pharmaceuticals, and for transport. The USA produces in monetary terms the largest proportion of the world’s oil, followed by Russia, Saudi Arabia (about 12%), and China, Iraq and Canada in 2023-24.[54] It is a product produced worldwide in Latin America, and the Middle East, but the 12 OPEC countries produce about 35% (which controls the price of oil by limiting supply), of the world’s oil and 72% comes from the top 10 producers, and the largest producers. International sanctions on Russia due to the war in Ukraine, make it now the third largest producer, which exports to China and India, amounting to 11.8 % of the world’s global production.[55] Should those nations stop buying Russian oil, the war may become unsustainable providing some border for Ukraine with Russia.

OPEC which represents many of the Gulf States, and African Countries, controls prices, and these have more recently peaked at about $74 per barrel in 2024. However, on 8 January 2025, this peaked to $81.72 per barrel, but it has begun to drop slightly.[56] Despite Sanctions Russia will still continue to produce oil, President Trump has focused attention on trying to reduce Russian revenue from oil which has fed the war in Ukraine, by cutting the price of OPEC prices, making options more competitive. Since the war began in 2021, it has increased Russian oil production by 2% and exports have increased by 7%. Russia is exporting more and has invested in a new fleet to transport oil from export to new customers in Asia and Latin America. [57] Both the EU, the UK and USA have issued sanctions, to limit resources secured by Russia to continue the war. It will be significant to see what Trump will do next, in relation to both Russia and Gaza, in the Middle East, his ability to shift politics, will impact the geopolitics in the region Europe and the Middle East and the global economy through negotiations in trade relations and discussions about trade tariffs, illegal migration, security and defence.

The cost of oil for fuels and industry impacts the cost of living directly and the domestic inflation of nations, stability in the oil price markets are essential, otherwise they can cause tipping points in more sensitive areas of the world which can lead to further tensions.

Services

The Service Sector includes the leisure, business, tourist, retail and administrative (public sector) and financial services of the economy. A recent Parliamentary note states that it accounts for 81% of the UK economic output (gross added value) and provides for 83% of the country’s employment. There was a small rise in Services output in October-November 2024.[58] From the previous year 2023, there was a 1.3% increase in Service sector output in 2024. The ONS identify the increase to services in ‘human health and social services’, but that this was offset by a decrease of 1.3% in ‘administrative and support service activities’ across the sector.[59] This is by far the largest economic sector of the UK Economy.

The resilience in this sector is one of the UK’s strengths and sectors here remain strong, but with low growth, as the there is less investment in businesses. Decline in trade with the EU of around 23% and some reliance on imports from the EU, could suggest a small trade imbalance for the UK. An Announcement at Davos The World Economic Forum in January 2025, about the UK being welcomed into entering the Pan-European and Mediterranean Convention, is an interesting proposal and will be politically significant to follow-up discussions, on whether it would open an easier path for trade with the EU in 2025-26 and going forward.

The size and strength of the sector is illustrated by ONS data in the graph below, it is unlikely that the services provided will suddenly shrink, with the exception of discreet rare events such as another pandemic, war or a large scale economic shock caused by environmental disaster or financial services breakdown due to poor Banking regulation. These areas are expected to remain as they are and there are few signs of immediate weakness. There are of course small changes in the sectors, if consumer confidence falls, the leisure and retail sectors are always affected first, but recover as confidence rises. With changes in AI we might expect some change in public sector administrative services to the public, it may be that the public service change to customers, making efficiencies in one area, whilst opening development for some in other technologies, but with fewer more discreet jobs requiring higher STEM skills. It will also take some time before the rise in tuition fees will impact Universities – this may cause decline in numbers attending universities in the UK, causing a resource shortage for some university Departments – Cardiff University is already cutting degree courses in Wales. With public sector funding of tertiary education, there must be balanced approach to maintain a diversity of culturally valuable courses in creative industries, whilst delivering those which provide necessary skills for graduates to gain employment.

ONS Data – index for service sectors 2024 data

Conclusion

The Centre for Inclusive Trade Policy state that the UK could benefit by joining the Pan Euro Mediterranean Convention, the UK Government at Davos stated that it did not cross the Labour Government Red lines, but it had no intention to seek to join it “at the present moment”.[60] The UK appears open to some discussions on a Pan-European arrangement. It is how the markets react which impact home and foreign policy, as mixed investor confidence matters and real investment, matters most. GDP growth is something a government can manage, and decisions to invest the billions of UK pounds sterling from final salary pensions surplus, largely from the public sector salary pot, to reinvest in UK approved companies and deals, is one way of making money work within a legitimate investment portfolio that is lower risk to pensioners.

Those advocating such a move, point to advantages in decreasing costs in trade, through better or no tariffs. Given the USA may increase and set tariffs for the UK going forward, this could be an option, along with diplomatic negotiations, to understand the levers that the USA intend to access. Tariffs are likely to increase prices and market analysts will be looking at the US stock exchange, which is expected to dominate the global stage.[61] Despite shifts in policies such as immigration to the USA which does impact labour growth, an economy which has been dependent on immigration for many years will be impacted at some level. With the Trump’s Administration recent attempts to curb migration, Goldman Sachs and Schroders predicted growth of 2.4% in the US Economy may need to be reconsidered. Growth in AI and new start ups also drive to make the US a power in the global economy and it may like to compete with powers such as Britain for a stake in new technologies. [62].

US Protectionist policies, if implemented at speed will close off investment from migrants who create new self-funded start-ups from money brought into the USA, if this pool of creativity falls, there may be some shrinkage in this area of growth over five years. Current growth has been fuelled by real investments, but new policies on migration may deter new investors who need to settle in the USA. As the USA remains worthy of investment, shift to international remote working from other nations to the USA may be a vision of future growth and prosperity whilst maintaining borders and lower migration.

It is reported that “the dozens of executive orders signed last week by President Trump have boosted the fortunes of some UK-listed companies and hindered others.” “On a company level, renewables and electric vehicle companies traded down on the removal of government funding packages and support for onshore wind projects, while oil and gas and mining companies saw share prices climb on hopes of a quick shift to looser regulatory environment, UK listed oil and gas companies Diversified Energy (DEC) and Pantheon Resources (PANR) continued rises that began with President Trump’s re-election”.[63] Looking at wider trade – Biotech is another potential area of growth, such as pharmaceutical companies.

A secure and stable Banking regime is one of the most important aspects of reducing risks in the Global Economy. Differing views on the quantity and quality of regulation amongst the world’s banks can mean that the Banking System is more challenged, in a crisis or can become more exposed. The Bank of England has at present decided to delay implementation of Basel 3.1, and it is looking to events in the USA and the US Banking regulation for clarity.[64] The European Central Banks are also in favour of and uptodate regime, but this is currently differed.[65]

The question remains how the UK will provide 2.5% of GP into defence spending, where more may be needed. The Government will publish its pathway towards that in the Spring. Defence is an area of growth as countries look at commitments across Europe, and there is evidence that there is growth in shipping for defence purposes. A ceasefire in Ukraine would mean some defence investors may take flight, with shifting priorities to replace decaying state defence infrastructures instead, investment is likely to continue for that purpose.

Bibliography

Blue Labour the Politics of the Common Good, by Maurice Glasman. Polity Press 2024.

Foreign Affairs, The Price of American Retreat. Why Washington must reject isolation and embrace primacy. Mitch McConnell. Published 16 December 2024.

Investor’ Chronicle, Investment Ideas and Education, A five Year outlook. The big asset class calls from now until 2023. From Exceptionalism to ‘golden age’, Rosie Carr page3 -9. 24-30 January 2025. Financial Times.

Investor’s Chronicle, Investment and Ideas and Education. Ideas of the Year. Our top share and fund selections for the year ahead, page 3- 39. 3-9 January 2025. Financial Times.

Investor’s Chronicle Investment and Ideas and Education. Where to invest in 2025. The outlook for key asset classes in the year ahead, pages 3-53. 20 December – 2 January. Financial Times.

Investor’s Chronicle Investment and Ideas and Education. Top 50 Funds, Our 2024 selection of the UK’s best actively managed funds, pages 3. 13-19 September 2024. Financial Times.

Investor’s Chronicle Investment and Education. AIM 100, Our verdict on London’s biggest junior companies. 8-14 November 2024. Financial Times.

Investor’s Chronicle Investment and Ideas Education, What next for the North Sea? 29 December 2024. Financial Times.

Investor’s Chronicle Investment and Ideas Education, Is a Scottish Mortgage still a best buy? pages 6-12 December 2024. Financial times.

How states pay for wars, Rosella Capella Zielinski, 2016, Cornell University Press, Ithaca and London.

Sources:

UK Government Advanced Manufacturing Plan 2024, and updates. BEIS, UK Government.

World Trade Organisation Annual Report 2017.

House of Commons Library Notes, Economy, Trade, Industry. UK Parliament online. 2025. (see notes for links)

Economic Indicators, number 02786, 6 January 2025.

Economic Indicators, number 02794, 18 December 2024.

Trade in Goods and Services, Economic Indicators Number 02815, 23 December 2024.

UK Supply Chains and Uyghur and Turkic Muslim forced labour in China, 4 November 2024. CDP- 0142(2024).

The House of Commons Library, The UK Economy Dashboard. 18 December 2024/ and 2025. (Notes)

UK Office for National Statistics (ONS) online. (see notes for links)

OECD Publications online. Papers and online content. (see notes for links)

Policy Paper, HMT, UK-China Economic and Financial Dialogue: Factsheet. 2025.Updated 11 January 2025.

News media:

Reuters – UK should outlaw imports of goods made Xinjiang forced labour, say senior law makers, 16 September 2024.

The Times, UK Economic Growth (Coverage on UK Economic Growth) – 21-28 January 2024. President Trump, Executive Orders and migration from Latin America.

Podcasts:

UCL Policy Unit. Priorities for the new UK Government, 24 October 2024 (available online). YouTube.

LSE Find out what’s next for foreign policy, 21 January 2025 (available online). YouTube.

[1] Lord Hammond Interviewed on BBC Radio 4 on the UK Economy under a Labour Government 2024. 9 January 2025 World At One online.

[2] Foreign Affairs, January/February 2025, The Price of American Retreat. Why Washington Must Reject Isolation and Embrace Primacy. By Mitch McConnell Published 16 December 2014.

[3] The Times, Jack Bennett Economics Correspondent. The Biggest Risk to the Global Economy is war, 15 January 2025.

[4] Robert Wilkie interviewed by the BBC Radio 4 on 21 January outlines a positive neo-classical realist approach to President Trump’s announcements. He has led transition efforts since November 2024. Television Coverage of inauguration BBC https://www.bbc.co.uk/iplayer/episode/m00276p8/bbc-news-special-president-trumps-inauguration

[5] HMT Policy Statement by Rachel Reeves on 11 January 2025 China Economic and Financial Dialogue: factsheet. https://www.gov.uk/government/publications/2025-uk-china-economic-and-financial-dialogue-policy-outcomes/2025-uk-china-economic-and-financial-dialogue-fact-sheet. HMT publish a note on the Chancellor Rachel Reeves’ visit to China in January 2025, a visit which she defended in Parliament after accusations of being absent as the pound dropped https://www.gov.uk/government/news/chancellor-marks-600m-of-secure-growth-for-uk-economy-in-beijing

[6] Parliament TV, Notes 14 January 2025 in The House of Commons, 2025. Video Archive.

[7] Global Legal Action Coverage. https://www.glanlaw.org/single-post/legal-opinion-concludes-that-treatment-of-uyghurs-amounts-to-crimes-against-humanity-and-genocide. BBC Coverage https://www.bbc.com/news/world-asia-china-59595952 European Position in March 2023 coverage https://www.ft.com/content/9af27168-0a88-4619-921b-6de7407b3143. UK Parliament records on legal framework and implementation of Moden Anti-Slavery Legislation.

[8] UCL Podcast, Political Sciences, Priorities for the new UK Government: Economic Growth (and its limits) Recorded on 24 October, available on 4 November 2024 (Notes from Podcast). Emily Fry, Shanker Singham, Competre Ltd, Luke Rukes, Lucy Barnes Professor of Political Economy at UCL, Department of Political Sciences.

[9] The rate of UK Inflation November 2024. https://www.ons.gov.uk/economy/inflationandpriceindices

[10] Secretary of State for Investment is interview in The Times, on 17 January 2025. https://www.thetimes.com/article/153be01a-3f54-4936-881f-55fbaa9ef6e8

[11] Parliament and Government – House of Commons Library Research note https://commonslibrary.parliament.uk/research-briefings/sn02815/

[12] Ibid.

[13] ONS published data to be updated in February 2025. https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/balanceofpayments/julytoseptember2024

[14] ONS CPI figures from 2015 Dashboard available showing rises and falls in UK inflation over the years and months. https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/d7g7/mm23

[15] ONS GDP Chained product volume measures dashboard shows a stead rise in this measure since 1955. https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/abmi/qna

[16] House of Commons Library Dashboard, UK Parliament: The UK Economy dashboard. https://commonslibrary.parliament.uk/the-uk-economy/. Also See The Times, The Economy grows less than expected article, 16 January 2025. https://www.thetimes.com/business-money/economics/article/uk-economy-news-gdp-latest-khjk2fqmm

[17] House of Commons Library Dashboard, UK Economy Dashboard. January 2025. https://commonslibrary.parliament.uk/the-uk-economy/ Data is linked to the ONS.

[18] Ibid. RPI includes student loans and travel costs.

[19] Industries in the UK https://commonslibrary.parliament.uk/research-briefings/cbp-8353/

[20] House of Commons Library https://commonslibrary.parliament.uk/research-briefings/cbp-8353/

[21] House of Commons Library https://commonslibrary.parliament.uk/research-briefings/sn02784/. Data on UK forecast were said to be slightly adjusted on 17 January 2025 by 0.1%. This was for November and largely seen as flat growth over the three-four months September-December 2024.

[22] ONS Employment data undated December 2024 https://commonslibrary.parliament.uk/research-briefings/sn02796/?mc_cid=811946798d&mc_eid=e6467d1936

[23] Labour Market data for 2024 https://www.beta.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes;https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/compendium/economicreview/april2019/longtermtrendsinukemployment1861to2018, Employment figures through the decade of the 1980’s varied considerably from 62%-72% (ONS).

[24] Ibid quote from ONS.

[25]https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicspending/bulletins/ukgovernmentdebtanddeficitforeurostatmaast/september2021

[26]ONS figures Government Finances. https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/bulletins/publicsectorfinances/september2024

[27] Notes from the Institute for Government Conference 2025, Section on Local Government and Devolution. White Paper on Local Government and bill discussed. 21 January 2025. Rocio Ferro-Adams.

[28] Commentary on the Public Sector Finances January 2025, https://obr.uk/hero/year-to-date-borrowing-remains-above-forecast-due-to-higher-than-expected-local-authority-borrowing/ and https://obr.uk/docs/dlm_uploads/PSF-commentary-December-2024.pdf

[29] Ibid.

[30] Agriculture report produced by DEFRA 2023, published online by the Department.

[31]DEFRA Food Security Report 2024. https://www.gov.uk/government/statistics/united-kingdom-food-security-report-2024/united-kingdom-food-security-report-2024-theme-2-uk-food-supply-sources

[32] DEFRA Farming Evidence – Key Statistics. https://www.gov.uk/government/publications/farming-evidence-pack-a-high-level-overview-of-the-uk-agricultural-industry/farming-evidence-key-statistics-accessible-version

[33] Ibid.

[34]Budget and New Duty Increases, The Wine and Spirits Trade Association 14 November 2024 https://wsta.co.uk/budget-2024-briefing-and-new-alcohol-duty-rates/

[35]FDF with the Food and Drinks Federation of Exporters https://www.fdf.org.uk/globalassets/resources/publications/reports/trade-reports/trade-snapshot-h1-2024.pdf

[36]Ibid.

[37] Ibid.

[38] OBR 22 January 2025, Costing of changes to agriculture and business property relief. Supplementary note. https://obr.uk/docs/dlm_uploads/IHT-APR-and-BPR-supplementary-release-Jan-2025.pdf And https://www.farminguk.com/news/obr-s-figures-on-farm-inheritance-tax-changes-highly-uncertain-_65941.html

[39] House of Commons Library note Manufacturing 16 January 2025

[40] ONS Data. https://www.ons.gov.uk/businessindustryandtrade/manufacturingandproductionindustry and https://www.makeuk.org/insights/publications/uk-manufacturing-the-facts-2024

[41] Library notes from the House of Commons. https://researchbriefings.files.parliament.uk/documents/SN05206/SN05206.pdf

[42]Ibid.

[43] The UK’s Modern Industrial Strategy 2024. https://www.gov.uk/government/news/government-launches-industrial-strategy-advisory-council-to-boost-growth-and-living-standards Published 24 November 2024.

[44] Ibid.

[45] Ibid.

[46]Massive boost for the UK motor industry as £50m investment deal secured. https://www.gov.uk/government/news/massive-boost-for-uk-motor-industry-as-50-million-investment-deal-secured

[47] House of Commons Library note https://post.parliament.uk/research-briefings/post-pb-0045/

[48] Mining and the Sustainability of Metals https://post.parliament.uk/research-briefings/post-pb-0045/

[49] ONS statistics on mining, for 20222, not updated. https://www.statista.com/topics/7156/mining-industry-in-the-uk/#topicOverview

[50] ONS statistics on trade deficit figures for mining 2014-2021. https://www.statista.com/statistics/1490753/united-kingdom-mineral-trade-balance/

[51] ONS total sector mineral exploration. https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/efn6/cxnv

[52] Reuters 1 October 2024, Australia’ Rio Tinto to develop lithium supply with UK Firm. https://www.reuters.com/markets/commodities/australias-rio-tinto-develop-lithium-supply-chain-with-uk-firm-2024-10-01/ Combined revenue of mining companies worldwide, ONS https://www.statista.com/statistics/208715/total-revenue-of-the-top-mining-companies/

[53] ONS Metal mining industry in the UK. https://www.statista.com/topics/7124/metal-mining-industry-in-the-uk/#topicOverview

[54] Our World in Data, Oil Production https://ourworldindata.org/grapher/oil-production-by-country?country=NOR~IRQ~USA~ARE~GBR~CHN~CAN~SAU OPEC countries are Angola, Algeria, Equatorial Guinea, Republic of the Congo, Gabon, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela.

[55] Statista Russian oil production data. https://www.statista.com/topics/5399/russian-oil-industry/#statisticChapter

[56] Prices of oil per barrel by group of OPEC Countries – January 2025. https://www.opec.org/opec_web/en/data_graphs/40.htm

[57] Reuters, 27 January 2025.

[58] Service Industry and Economic Industries https://researchbriefings.files.parliament.uk/documents/SN02786/SN02786.pdf

[59] Index of Services, UK: November 2024. https://www.ons.gov.uk/economy/economicoutputandproductivity/output/bulletins/indexofservices/november2024

[60] https://citp.ac.uk/publications/should-the-uk-join-pem

[61] Investor’ Chronicle, Investment Ideas and Education, A five Year outlook, 24-30 January 2025. From Exceptionalism to ‘golden age’, Rosie Carr page3.

[62] Ibid.

[63] Ibid, page 9 Investors Chronicle ‘Trump return brings trade and tax fears but boosts resources and AI stocks’. January 2025.

[64] The PRA Announces a delay in the implementation of Basel 3.1. https://www.bankofengland.co.uk/news/2025/january/the-pra-announces-a-delay-to-the-implementation-of-basel-3-1

[65] Basel III Finalisation in the EU. https://www.ecb.europa.eu/press/financial-stability-publications/macroprudential-bulletin/focus/2023/html/ecb.mpbu202312_focus01.en.html

Leave a comment